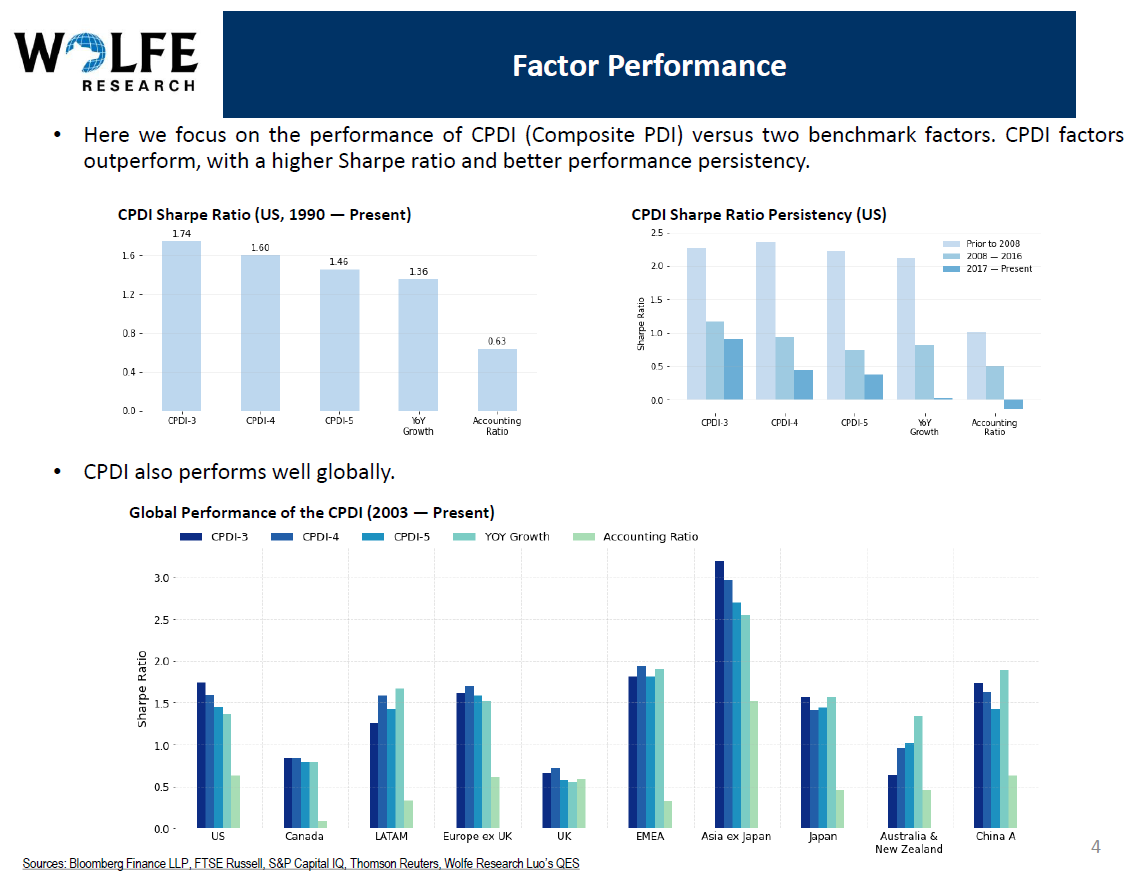

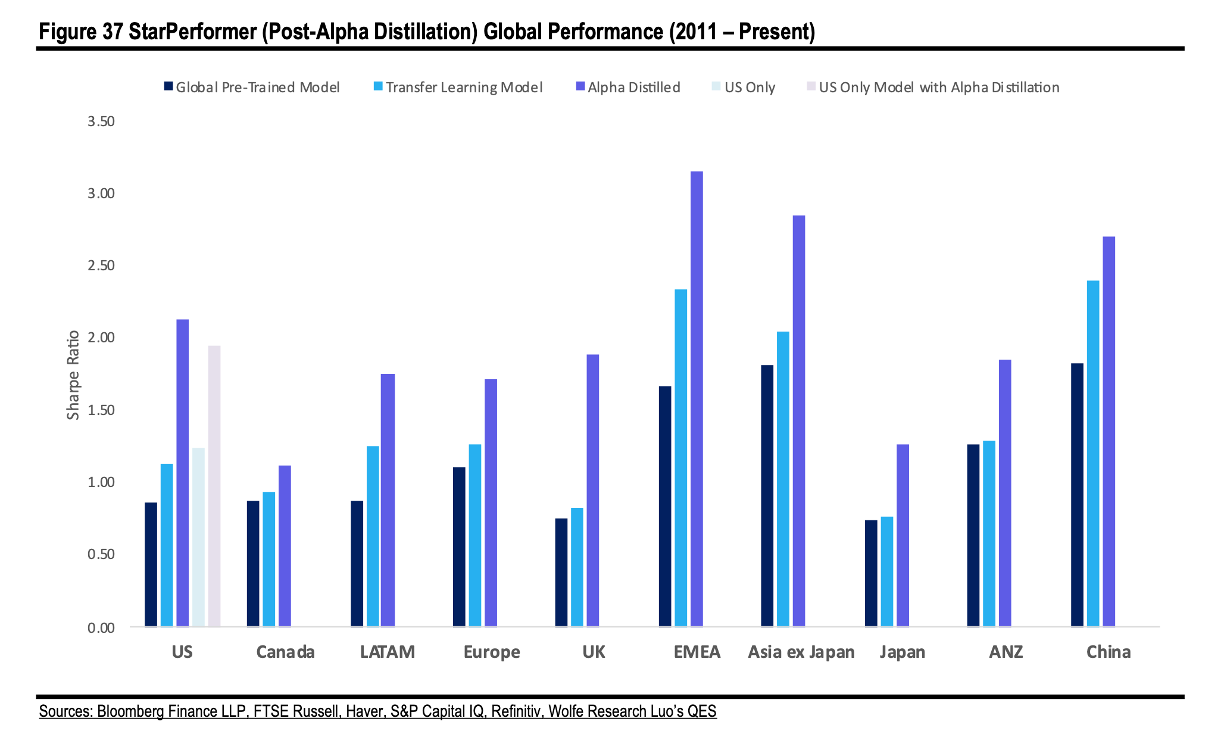

Yin Luo and the Top-Ranked QES team have spent the last 25+ years developing numerous data feeds that are based on our vast factor libraries. The Global Factor Library contains over 3,500 proprietary factors that utilizes point-in-time data to form the raw ingredients and inputs into our quantitative models. Unlike most conventional quantitative techniques, our models deliver superior alpha even in a highly concentrated portfolio.

Our models are uncorrelated to traditional investment process; therefore, fundamental and discretionary managers can incorporate our models to supplement their existing investment process. Further, our research focuses on alternative Big Data and machine learning. We strive to identify new and innovative ideas. Most quantitative investors should find our models uncorrelated to their existing strategies.

Our team specializes in the following data feeds…

Our Team

The QES team has been working at the forefront of the systematic revolution for 20+ years. Many members of our team have spent their entire careers together, and the QES team now has over 20 dedicated quantitative researchers across the world. The team has specialists in every aspect of quantitative research, from alternative data, factor construction, machine learning/NLP, stock-selection model, ESG, and global macro, we strive to address the needs of quantitative and fundamental investors alike. As the quantitative investment landscape continues to evolve, rest assured that the Wolfe QES team will continue to innovate on all fronts.